The global market for photogrammetry software is a theater of intense and highly technical competition, where software vendors are battling to provide the most accurate, efficient, and scalable solution for transforming images into 3D data. A close examination of the Photogrammetry Software Market Competition reveals a rivalry fought not just on user interface and price, but on the fundamental quality of the underlying algorithms, the speed of processing, and the ability to handle massive datasets. The competitive landscape pits established, high-precision specialists against the integrated offerings of major design software platforms and the growing influence of the drone ecosystem. The market's explosive growth, fueled by the drone revolution, is the primary catalyst for this fierce competition. The Photogrammetry Software Market size is projected to grow USD 19.54 Billion by 2035, exhibiting a CAGR of 18.2% during the forecast period 2025-2035. This expansion creates a high-stakes environment where vendors are in a constant R&D arms race to improve their core processing engines and to stake their claim as the leading platform for creating digital twins of the real world. The competition is a sophisticated battle of computer vision expertise and computational efficiency.

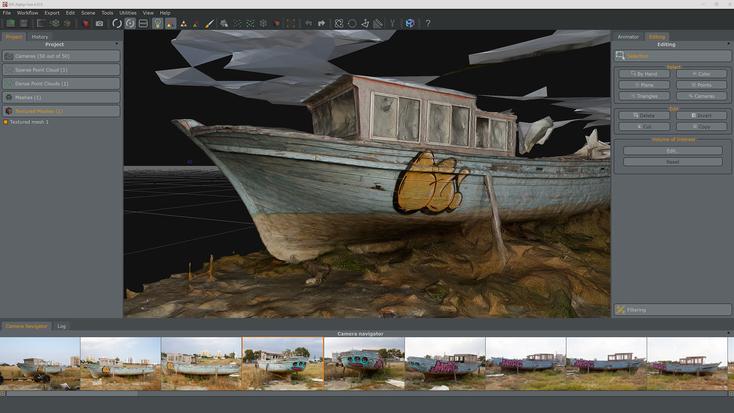

The central axis of competition is the head-to-head rivalry between the leading specialized photogrammetry software providers, primarily Agisoft (Metashape), Capturing Reality (RealityCapture), and Pix4D. This is a competition of technical excellence. These companies compete on the core performance of their Structure from Motion (SfM) and Multi-View Stereo (MVS) algorithms. The key competitive differentiators are processing speed (how quickly can the software process thousands of images), the quality and detail of the resulting 3D mesh, the realism of the textures, and, most importantly for professional applications, the metric accuracy of the final model. They are in a constant state of one-upmanship, with each new software release touting faster processing times, better handling of challenging scenarios (like reflective surfaces), and more accurate outputs. This competition is often played out in public benchmarks and case studies, as each vendor tries to prove its technological superiority to a highly discerning professional user base in fields like surveying, VFX, and cultural heritage. The quality of the core processing engine is the primary battleground in this segment of the market.

This primary rivalry is further complicated by the competitive strategies of the major integrated platform players. The AEC software giants like Autodesk and Bentley Systems are competing not by trying to have the single best photogrammetry engine, but by offering a "good enough" and seamlessly integrated reality capture workflow. Their competitive advantage is convenience. For an architect using Autodesk Revit, the ability to process photos and generate a 3D model directly within the Autodesk ecosystem using ReCap is a much simpler workflow than using a separate third-party application and then dealing with file format and data conversion issues. This "ecosystem pull" is a powerful competitive force that can siphon off users who prioritize workflow integration over the absolute highest quality output of a specialized tool. A second major competitive pressure comes from the drone manufacturers themselves, particularly DJI. While not a direct software competitor in the processing space, DJI's flight planning and data management software controls the front end of the workflow, giving it significant influence. Furthermore, the rise of cloud-based processing platforms is creating a new competitive front, where vendors compete not on desktop software, but on the speed and scalability of their cloud infrastructure to process drone data automatically.

Top Trending Reports -

US Outsourced Software Testing Market